Skip Volatility: Explore 30+ Bonds on Aspero

Why choose fixed income?

So you can live the life you’re working to afford

Invest & earn upto 15.00% returns

Discover superior fixed income investing on Aspero

Make debt an asset. Harness the power of fixed income and start investing with Aspero today

Start your investment journeyIn the News

Hear from Customers on Aspero

Backed by Marquee Investors

Start Learning Today

Have questions?

Get answers to the most frequently asked questions by retail investors

To begin investing in Bonds on Aspero, follow these steps:

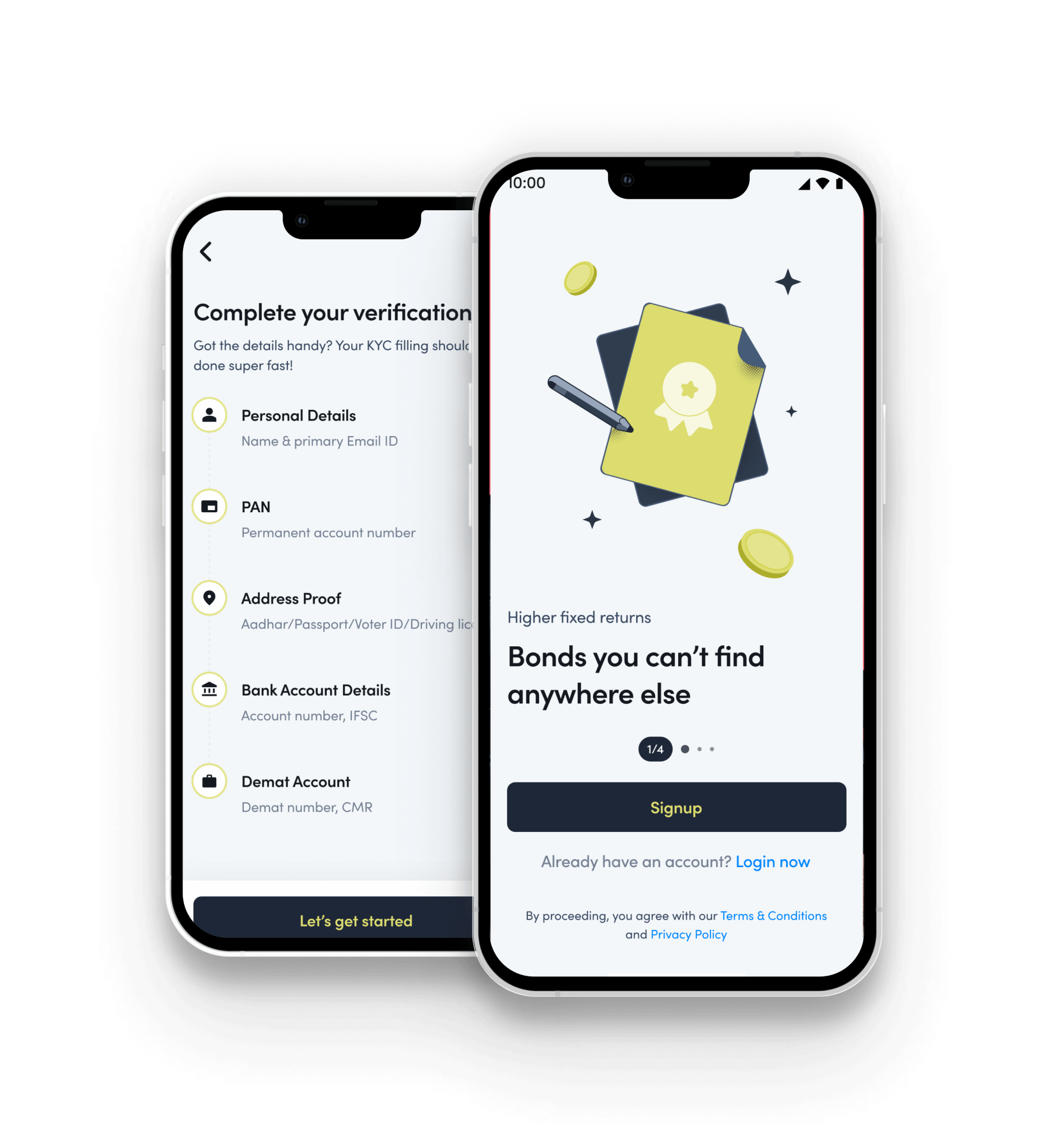

Step 1: Create an Account on Aspero

Step 2: Complete your KYC verification

Step 3: Search for bonds using ISIN or name

or

Choose the Bonds from one of the many categories listed on the platform. e.g. for High Yield, Short Tenure, Highly Rated & Budget bonds etc displayed for your convenience.

Step 4: You can also filter bonds on the basis of Tenure, Rating, Coupon Rate, Yield Rate & Maturity

Step 5: View bond details

Step 6: Click on “Invest Now” to purchase Bonds

Yes, as per government regulations, it is mandatory to complete your KYC verification to start investing. You are required to share your Full Name, Email ID, PAN card, Address Proof, Banks Details, and Demat Details to be eligible to invest.

You can simply log in to the platform with your phone number, verified by OTP. To begin investing, please upload the following:

PAN Card

Address Proof (Voter ID/Passport/Driver’s License)

A cancelled cheque/bank statement to verify bank account number & IFSC code

Client Master Report to verify your Demat account

A Client Master Report (CMR) is a digitally signed PDF certificate issued by a broker to a client. It contains information about your demat account, such as your demat ID, date of birth, bank information, and nomination information, amonother things. The CMR will be sent to your registered email address by your Demat provider or can be accessed from the Document/Report section on your respective broker platform like Zerodha, Groww or ICICI Securities

100% compliant as SEBI-registered OBPP

100% compliant as SEBI-registered OBPP